Statistical Analysis consists of code from the Chapter Lab Sections 4.6.1 and 4.6.2(Induction to Statitical book)

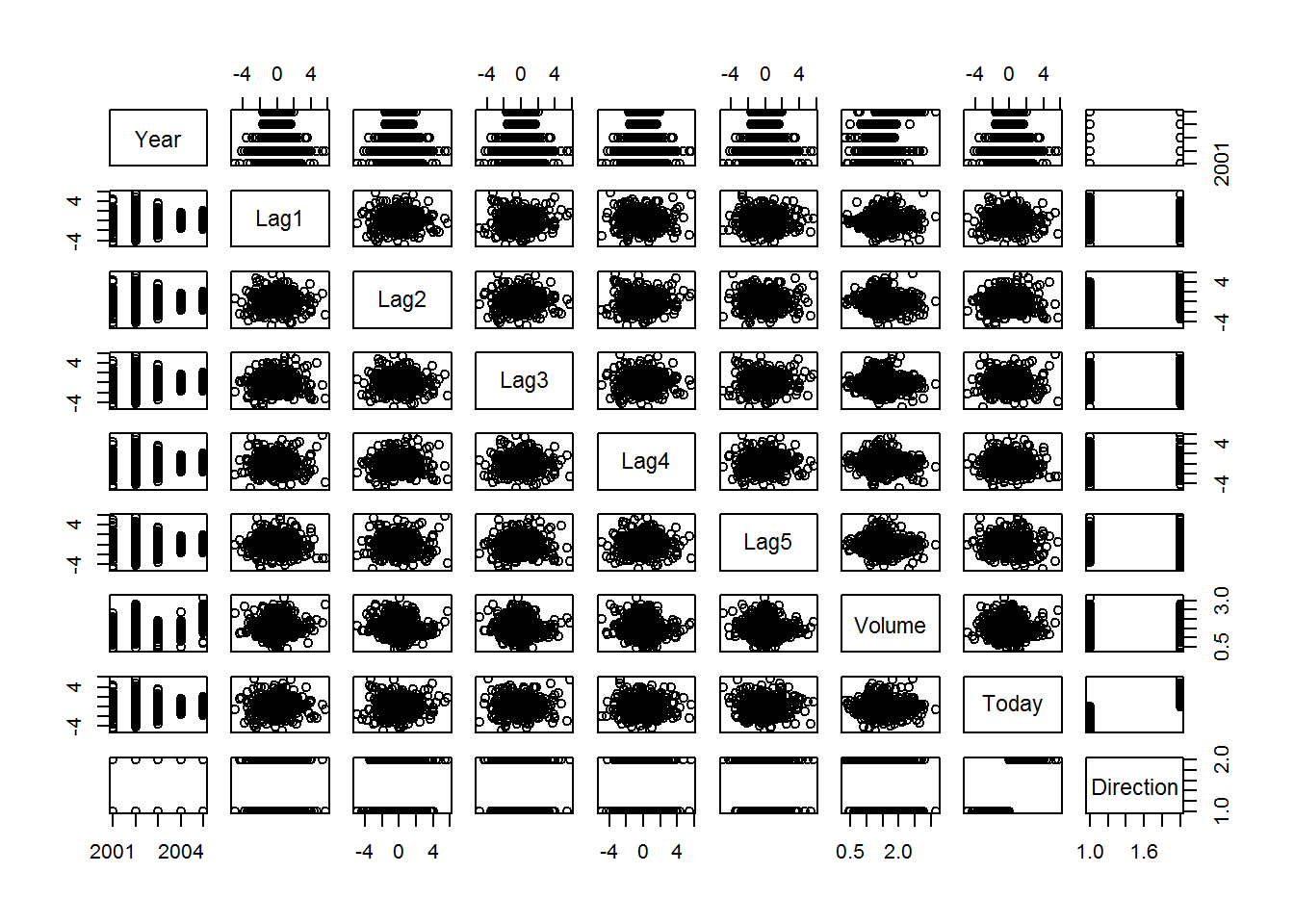

library (ISLR)## Warning: package 'ISLR' was built under R version 3.3.3names(Smarket )## [1] "Year" "Lag1" "Lag2" "Lag3" "Lag4" "Lag5"

## [7] "Volume" "Today" "Direction"dim(Smarket )## [1] 1250 9summary (Smarket )## Year Lag1 Lag2

## Min. :2001 Min. :-4.922000 Min. :-4.922000

## 1st Qu.:2002 1st Qu.:-0.639500 1st Qu.:-0.639500

## Median :2003 Median : 0.039000 Median : 0.039000

## Mean :2003 Mean : 0.003834 Mean : 0.003919

## 3rd Qu.:2004 3rd Qu.: 0.596750 3rd Qu.: 0.596750

## Max. :2005 Max. : 5.733000 Max. : 5.733000

## Lag3 Lag4 Lag5

## Min. :-4.922000 Min. :-4.922000 Min. :-4.92200

## 1st Qu.:-0.640000 1st Qu.:-0.640000 1st Qu.:-0.64000

## Median : 0.038500 Median : 0.038500 Median : 0.03850

## Mean : 0.001716 Mean : 0.001636 Mean : 0.00561

## 3rd Qu.: 0.596750 3rd Qu.: 0.596750 3rd Qu.: 0.59700

## Max. : 5.733000 Max. : 5.733000 Max. : 5.73300

## Volume Today Direction

## Min. :0.3561 Min. :-4.922000 Down:602

## 1st Qu.:1.2574 1st Qu.:-0.639500 Up :648

## Median :1.4229 Median : 0.038500

## Mean :1.4783 Mean : 0.003138

## 3rd Qu.:1.6417 3rd Qu.: 0.596750

## Max. :3.1525 Max. : 5.733000pairs(Smarket )

#cor(Smarket )cor(Smarket [,-9])## Year Lag1 Lag2 Lag3 Lag4

## Year 1.00000000 0.029699649 0.030596422 0.033194581 0.035688718

## Lag1 0.02969965 1.000000000 -0.026294328 -0.010803402 -0.002985911

## Lag2 0.03059642 -0.026294328 1.000000000 -0.025896670 -0.010853533

## Lag3 0.03319458 -0.010803402 -0.025896670 1.000000000 -0.024051036

## Lag4 0.03568872 -0.002985911 -0.010853533 -0.024051036 1.000000000

## Lag5 0.02978799 -0.005674606 -0.003557949 -0.018808338 -0.027083641

## Volume 0.53900647 0.040909908 -0.043383215 -0.041823686 -0.048414246

## Today 0.03009523 -0.026155045 -0.010250033 -0.002447647 -0.006899527

## Lag5 Volume Today

## Year 0.029787995 0.53900647 0.030095229

## Lag1 -0.005674606 0.04090991 -0.026155045

## Lag2 -0.003557949 -0.04338321 -0.010250033

## Lag3 -0.018808338 -0.04182369 -0.002447647

## Lag4 -0.027083641 -0.04841425 -0.006899527

## Lag5 1.000000000 -0.02200231 -0.034860083

## Volume -0.022002315 1.00000000 0.014591823

## Today -0.034860083 0.01459182 1.000000000attach (Smarket )

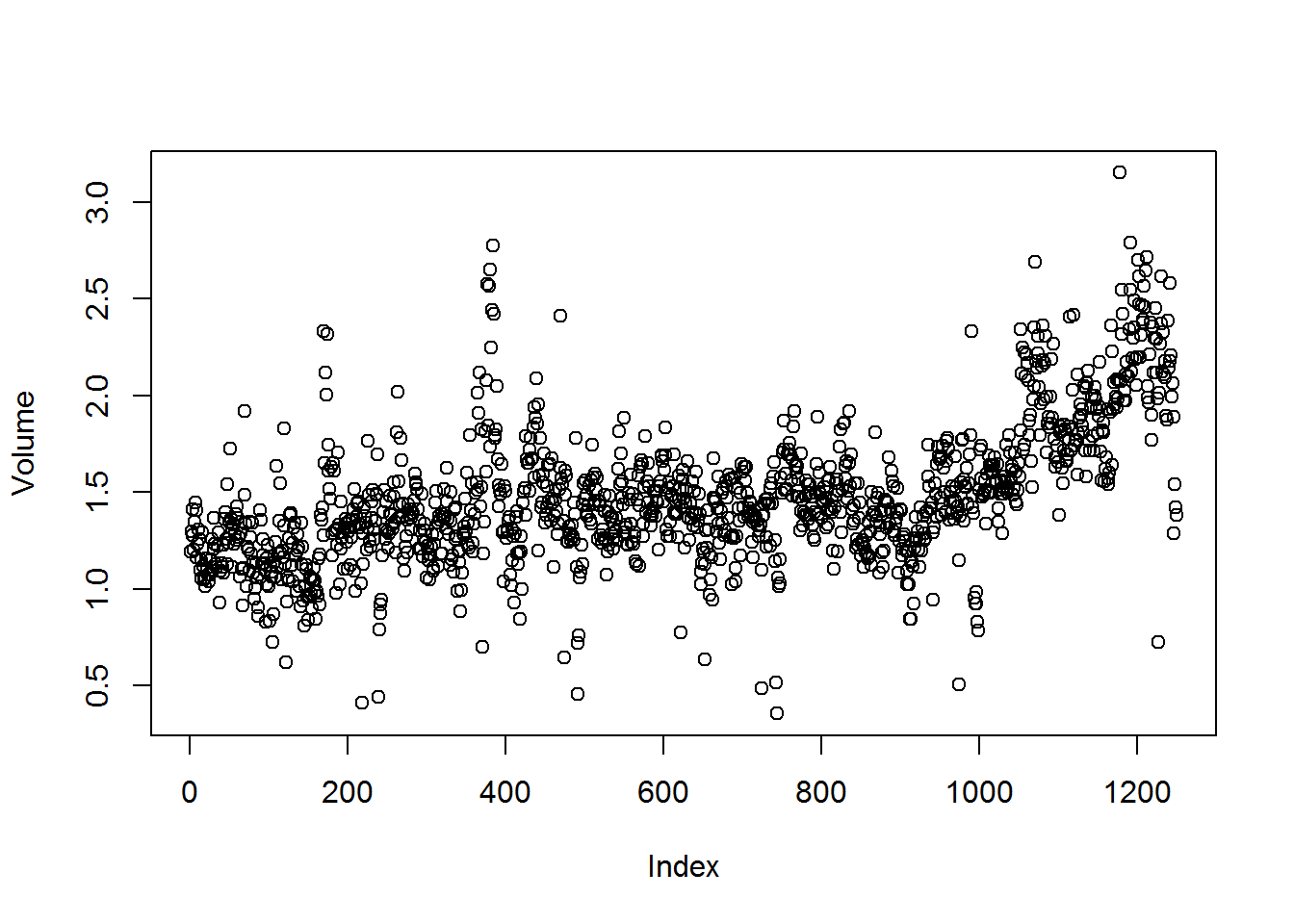

plot(Volume )

Following code runs the logististic Regression labcode 4.6.2

glm.fit=glm(Direction~Lag1+Lag2+Lag3+Lag4+Lag5+Volume ,data=Smarket ,family =binomial )

summary (glm.fit )##

## Call:

## glm(formula = Direction ~ Lag1 + Lag2 + Lag3 + Lag4 + Lag5 +

## Volume, family = binomial, data = Smarket)

##

## Deviance Residuals:

## Min 1Q Median 3Q Max

## -1.446 -1.203 1.065 1.145 1.326

##

## Coefficients:

## Estimate Std. Error z value Pr(>|z|)

## (Intercept) -0.126000 0.240736 -0.523 0.601

## Lag1 -0.073074 0.050167 -1.457 0.145

## Lag2 -0.042301 0.050086 -0.845 0.398

## Lag3 0.011085 0.049939 0.222 0.824

## Lag4 0.009359 0.049974 0.187 0.851

## Lag5 0.010313 0.049511 0.208 0.835

## Volume 0.135441 0.158360 0.855 0.392

##

## (Dispersion parameter for binomial family taken to be 1)

##

## Null deviance: 1731.2 on 1249 degrees of freedom

## Residual deviance: 1727.6 on 1243 degrees of freedom

## AIC: 1741.6

##

## Number of Fisher Scoring iterations: 3coef(glm.fit)## (Intercept) Lag1 Lag2 Lag3 Lag4

## -0.126000257 -0.073073746 -0.042301344 0.011085108 0.009358938

## Lag5 Volume

## 0.010313068 0.135440659summary (glm.fit )$coef## Estimate Std. Error z value Pr(>|z|)

## (Intercept) -0.126000257 0.24073574 -0.5233966 0.6006983

## Lag1 -0.073073746 0.05016739 -1.4565986 0.1452272

## Lag2 -0.042301344 0.05008605 -0.8445733 0.3983491

## Lag3 0.011085108 0.04993854 0.2219750 0.8243333

## Lag4 0.009358938 0.04997413 0.1872757 0.8514445

## Lag5 0.010313068 0.04951146 0.2082966 0.8349974

## Volume 0.135440659 0.15835970 0.8552723 0.3924004summary (glm.fit )$coef [,4]## (Intercept) Lag1 Lag2 Lag3 Lag4 Lag5

## 0.6006983 0.1452272 0.3983491 0.8243333 0.8514445 0.8349974

## Volume

## 0.3924004glm.probs =predict(glm.fit,type ="response")

glm.probs [1:10]## 1 2 3 4 5 6 7

## 0.5070841 0.4814679 0.4811388 0.5152224 0.5107812 0.5069565 0.4926509

## 8 9 10

## 0.5092292 0.5176135 0.4888378contrasts (Direction )## Up

## Down 0

## Up 1glm.pred=rep ("Down " ,1250)

glm.pred[glm.probs >.5]=" Up"table(glm.pred ,Direction )## Direction

## glm.pred Down Up

## Up 457 507

## Down 145 141(507+145) /1250## [1] 0.5216mean(glm.pred==Direction )## [1] 0train =(Year <2005)

Smarket.2005= Smarket [! train ,]

dim(Smarket.2005)## [1] 252 9Direction.2005= Direction [! train]glm.fit=glm(Direction~Lag1+Lag2+Lag3+Lag4+Lag5+Volume ,

data=Smarket,family =binomial ,subset =train )

glm.probs =predict (glm.fit ,Smarket.2005 , type="response")glm.pred=rep ("Down " ,252)

glm.pred[glm.probs >.5]=" Up"

table(glm.pred ,Direction.2005)## Direction.2005

## glm.pred Down Up

## Up 34 44

## Down 77 97mean(glm.pred== Direction.2005)## [1] 0mean(glm.pred!= Direction.2005)## [1] 1glm.fit=glm(Direction~Lag1+Lag2 ,data=Smarket ,family =binomial ,

subset =train)

glm.probs =predict (glm.fit ,Smarket.2005,type="response")

glm.pred=rep ("Down " ,252)

glm.pred[glm.probs >.5]="Up"

table(glm.pred ,Direction.2005)## Direction.2005

## glm.pred Down Up

## Down 35 35

## Up 76 106mean(glm.pred== Direction.2005)## [1] 0.4206349106/(106+76)## [1] 0.5824176predict (glm.fit, newdata =data.frame(Lag1=c(1.2 ,1.5),Lag2=c(1.1 , -0.8) ),type ="response")## 1 2

## 0.4791462 0.4960939Reference: An Introduction to Statistical Learning with Applications in R Authors: James, G., Witten, D., Hastie, T., Tibshirani, R.

Share this post

Twitter

Google+

Facebook

Reddit

LinkedIn

StumbleUpon

Email